How to Spend Cryptocurrency: Real Ways People Use Crypto in 2026

A practical guide to spending crypto in 2026, with clear steps, real examples, and beginner safety tips.

What You’ll Learn

- How crypto payments actually work, explained in plain language

- Real ways people use crypto for shopping, travel, bills, and online services in 2026

- Why stablecoins like USDT and USDC are commonly used for everyday spending

- The main beginner risks to watch for, including fees, scams, wrong addresses, and irreversible payments

- Tools that make spending crypto easier, including wallets, payment processors, and crypto cards

Introduction

Many people buy crypto and then hit the same wall:

Okay… but where do I actually use this?

For a long time, crypto mostly lived on charts and dashboards. Today, it shows up in more ordinary places: booking a flight, paying for software, sending money abroad or buying a gift card you can use the same day.

The difference becomes clear the first time you try to pay. Instead of asking a bank for approval, a crypto payment moves value directly from one wallet to another on the blockchain. Sometimes a checkout service handles the invoice or conversion in the background, but the payment itself is still settled on-chain.

After you go through that flow once, crypto shifts from something you hold to something you can pay with.

This guide walks through real ways people spend cryptocurrency in 2026. You’ll see concrete examples, what the payment looks like in practice, and what to check before you send anything. The goal isn’t to turn you into an expert. It’s to help you make a first payment without surprises.

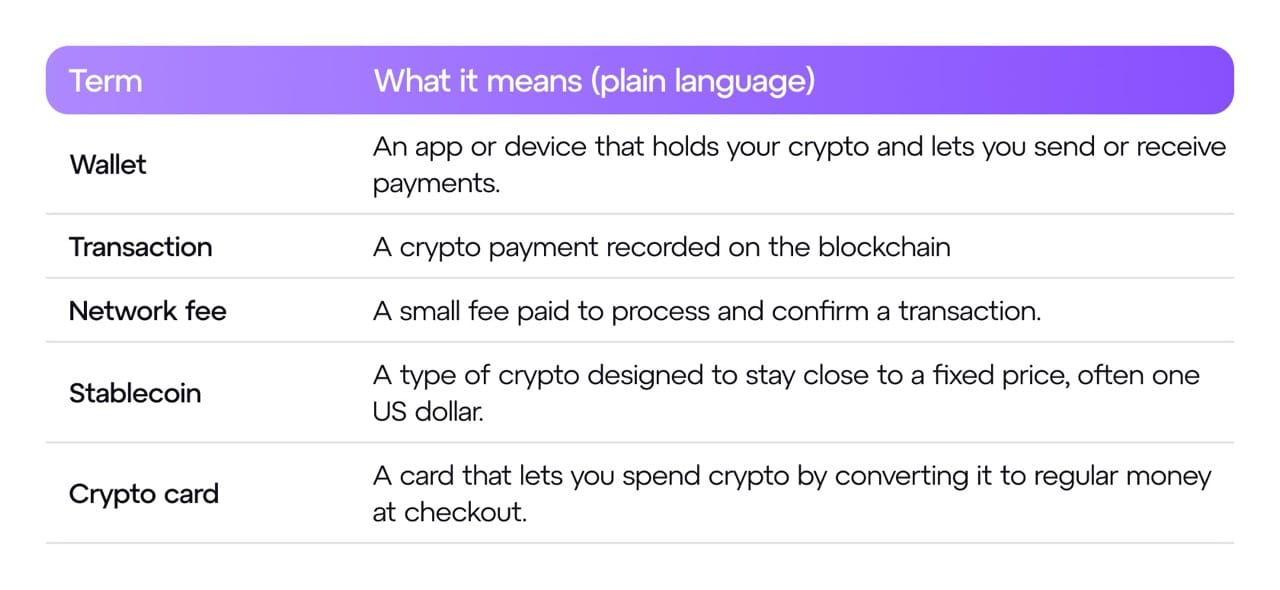

A short glossary, so the next sections are easier to follow.

With those basics in place, we can focus on what actually happens when you hit pay.

Table Of Content:

- How Spending Crypto Works (Explain Like I’m 10)

- Top Ways to Spend Cryptocurrency in 2026

- Costs & Fees: How to Spend Crypto Without Overpaying

- Tools Beginners Need to Spend Crypto Safely

- Conclusion

- FAQ

How Spending Crypto Works (Explain Like I’m 10)

When you spend crypto, a few simple things happen in a fixed order. It’s not the same as paying with a card, but it's easy to follow when the steps are laid out clearly.

Here’s what that first payment usually looks like.

Step-by-step basics

1) You choose what you’re paying for. It could be a product, a bill, a subscription, or a gift card. At checkout, you either select a crypto option or receive a crypto invoice with payment details.

2) You send crypto from your wallet. You’ll see a wallet address or a QR code. Your wallet shows the amount and the network. This is the moment where you pause, check the details, and confirm.

3) The blockchain confirms the payment. The network verifies the transaction and records it. Depending on the blockchain, this can take a few seconds or a few hours.

4) The merchant gets paid. Sometimes the merchant receives the crypto directly. Other times, a checkout service converts it to local currency in the background. That part depends on how the payment was set up.

Most crypto checkouts follow this same pattern. An invoice is created, you pay from your wallet, the network confirms it, and the funds arrive in one form or another.

That direct flow is the key difference between crypto and card payments. The steps stay the same, but the asset you use can change how smooth the payment feels.

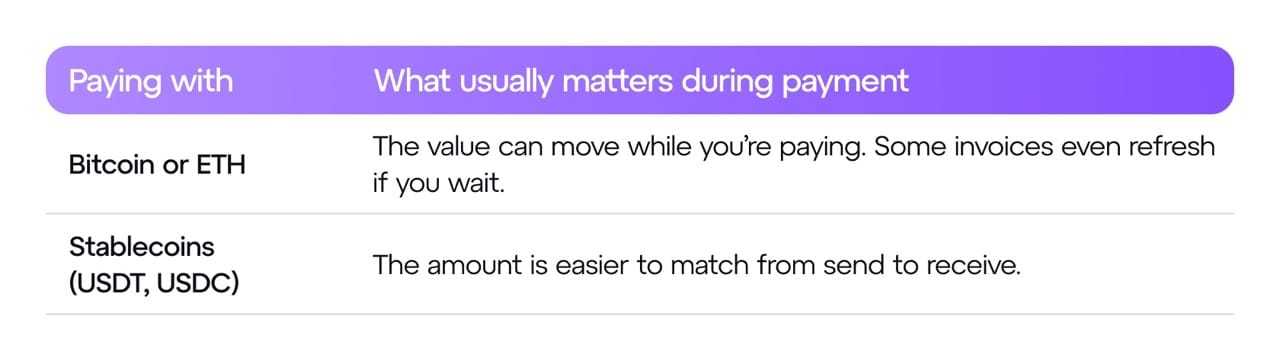

Why Stablecoins Matter For Spending

If you watch how people actually pay with crypto, you’ll notice stablecoins like USDT or USDC come up a lot.

The reason becomes obvious during checkout.

When you’re paying for subscriptions, services, or digital goods, having fewer moving parts helps. Stablecoins remove one variable while you’re still learning how the flow works.

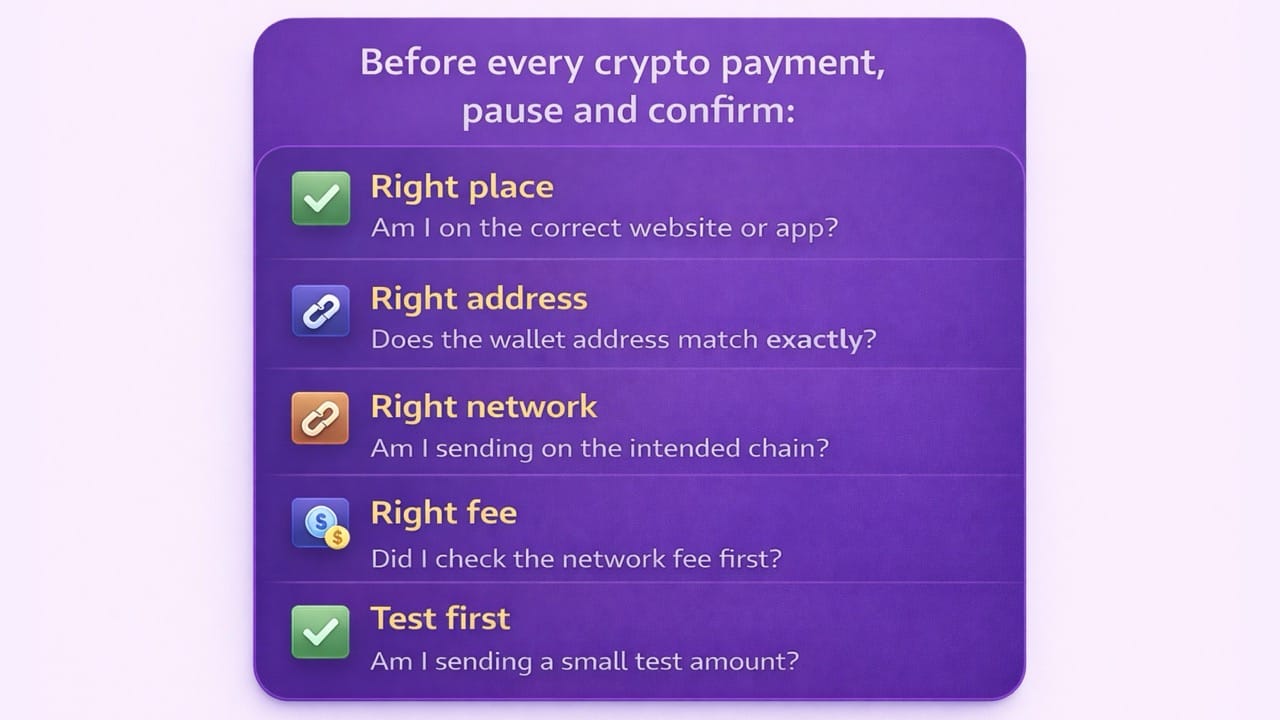

A Few Things Worth Knowing Before You Send Crypto

Most beginner issues don’t come from the big steps. They come from small details people overlook the first time.

- Fees don’t behave like card fees. They change based on the network and how busy it is. A small payment can cost more than expected if it’s sent at the wrong time or on the wrong chain.

- Addresses have to be exact. Crypto goes to a specific wallet address. If even one character is wrong, the funds will not reach the intended destination.

- Undo is limited. Once a transaction is confirmed, it usually can’t be reversed by the network. If a refund is needed, it depends on the merchant or platform, not the blockchain.

That’s why many experienced users start with a small test send, especially when paying a new person or using a service for the first time.

Now that the payment flow is clear, let’s look at the real ways people actually spend crypto in 2026.

Top Real Ways to Spend Cryptocurrency in 2026

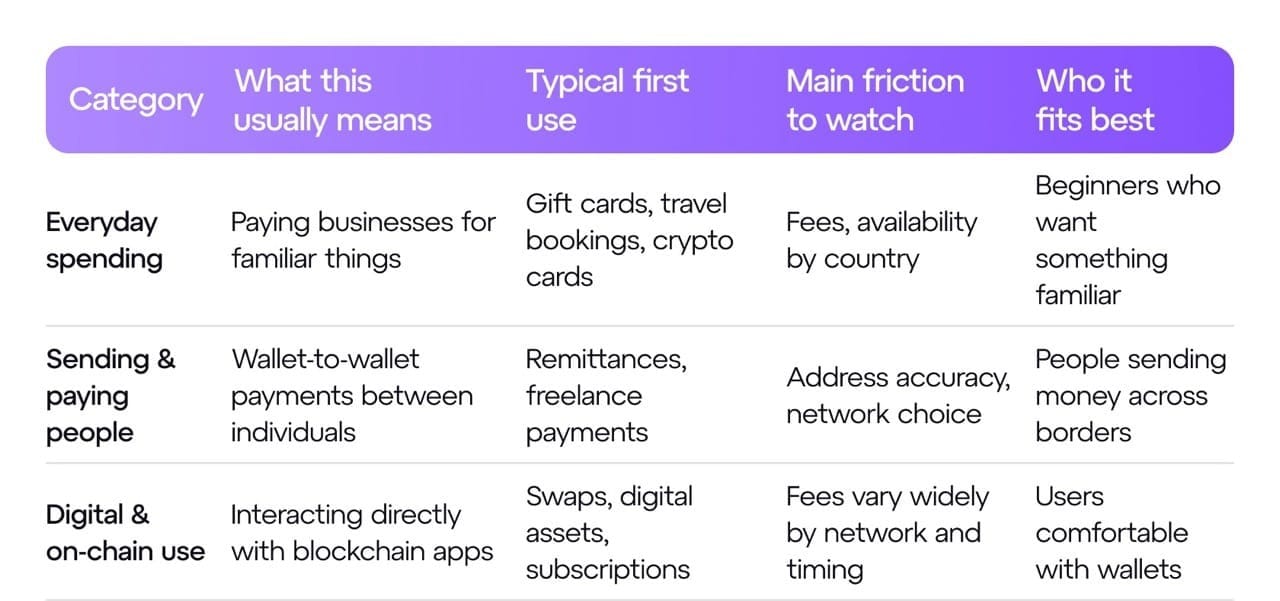

There isn’t one single way people spend crypto. What changes is who you’re paying and how much of the process happens on-chain.

Sometimes you’re paying a business through a standard checkout. Sometimes you’re sending money directly to another person. Other times, you’re interacting directly with the blockchain.

Grouping the options this way makes it easier to answer a common beginner question:

“Which of these fits where I’m at right now?”

A quick map of how crypto spending shows up

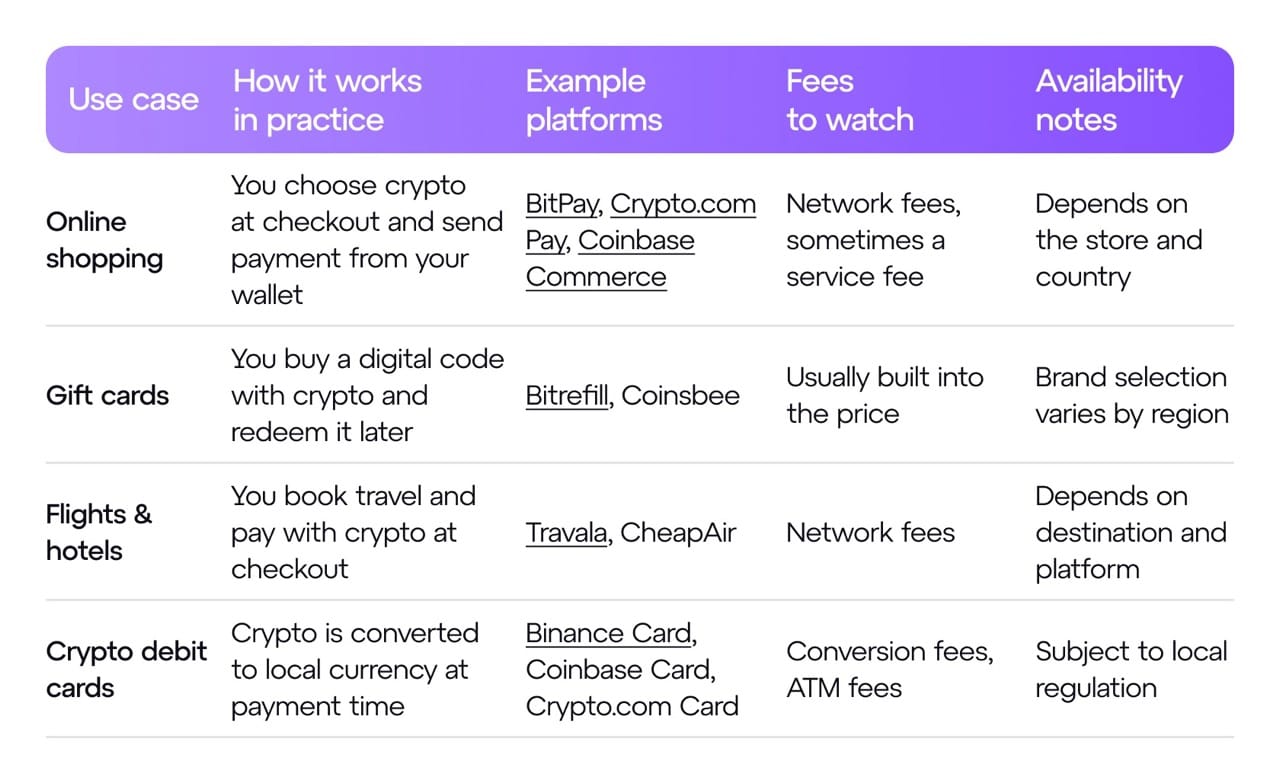

🛒 Everyday Spending (Most Beginners Start Here)

This is where crypto spending looks most similar to everyday purchases. You’re paying for things you would buy anyway: shopping online, booking a flight, or paying with a card.

What changes isn’t the purchase. It’s the payment rail underneath.

For beginners, this category works well because the result is immediate, the checkout flow is usually guided, and mistakes are less likely to be permanent.

Everyday Crypto Spending Options

For many people, this is their first practical use of crypto.

Because crypto cards convert funds at checkout, they behave differently from traditional debit cards in terms of fees, timing, and control.

In physical stores, crypto payments usually rely on QR codes. For Bitcoin, these payments are typically routed through the Lightning network, which enables fast, low-fee transactions at the point of sale when supported.

Crypto ATMs are often used when cash is needed quickly, not because they’re cheap.

Across all of these options, the biggest difference isn’t what you’re buying. It’s how the payment is processed — and how much that processing costs.

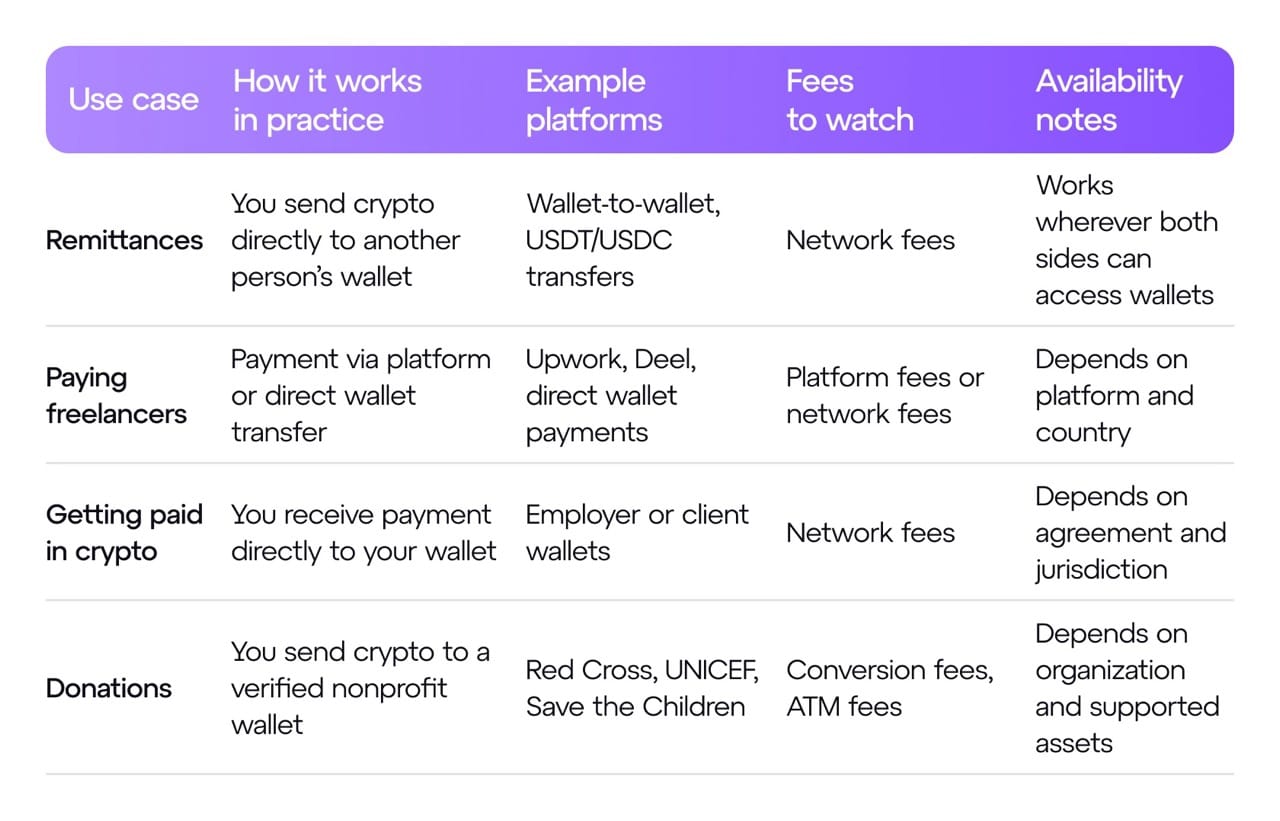

🌍 Sending & Paying People

This category is about person-to-person value transfer. Instead of paying a business, you’re sending crypto directly to someone else or receiving it yourself.

This is where crypto payments diverge from traditional systems. You’re no longer limited by location, only by wallet access.

Sending and paying people with crypto

Why stablecoins are common here:

Both sides want clarity on the amount. There’s no paperwork, no bank approval window, and no dependency on business hours.

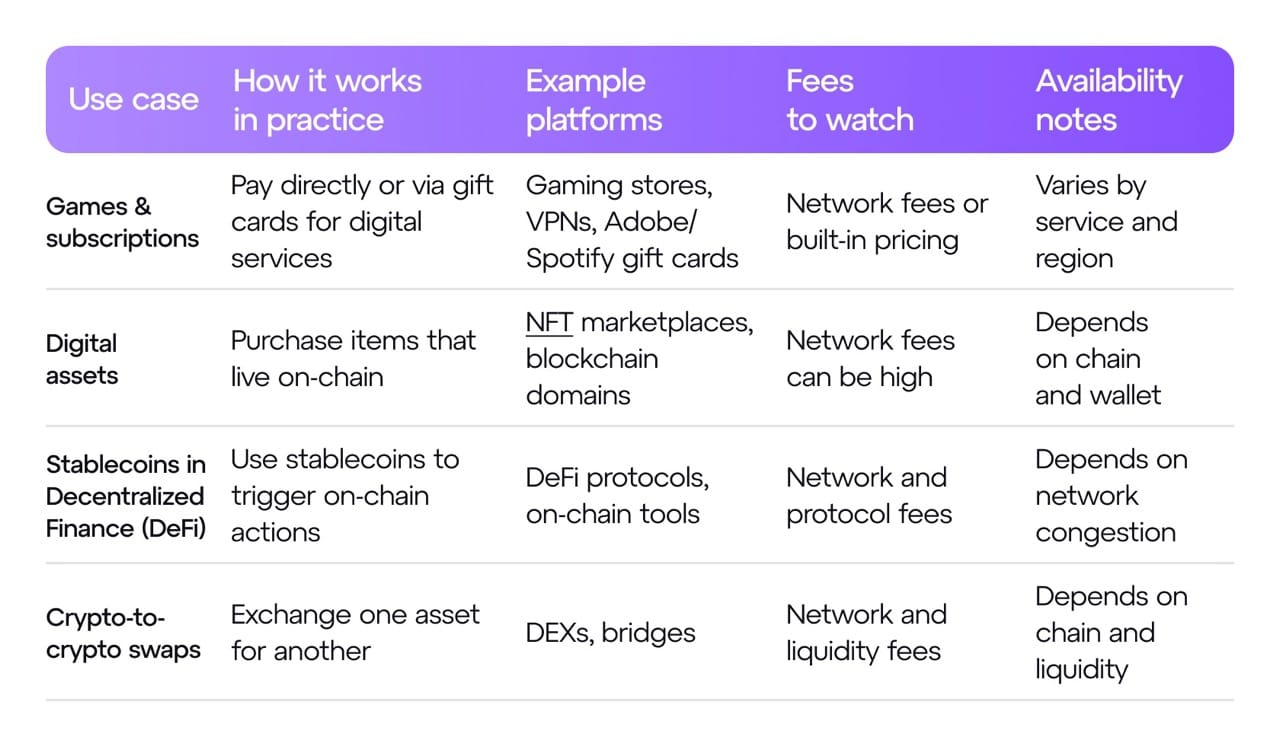

🧩 Digital & On-Chain Use

Here, crypto never leaves the blockchain. You’re not paying a company in the usual sense. You’re interacting with protocols, marketplaces, or smart contracts that execute actions automatically.

This is where cost, timing, and network choice start to shape the experience.

Digital and on-chain crypto spending

This is where fees and timing start to matter more. The same action can cost very little on one network and much more on another.

Swaps are a useful mental bridge. Even though nothing is “bought” in a store, value is exchanged and fees apply. That’s why swaps still count as spending, even when everything stays on-chain.

Costs & Fees: How to Spend Crypto Without Overpaying

Crypto fees aren’t random, but they often surprise people the first time a payment costs more — or takes longer — than expected. That surprise usually comes from a simple trade-off: speed versus cost.

If you want a transaction confirmed quickly, you usually pay more. If you’re willing to wait, or choose a different network, fees are often lower.

Every crypto payment includes a network fee, which is paid to the network’s validators or miners (the computers that process transactions). Some apps also add a separate service fee, depending on how the payment is handled.

Network Fees Explained

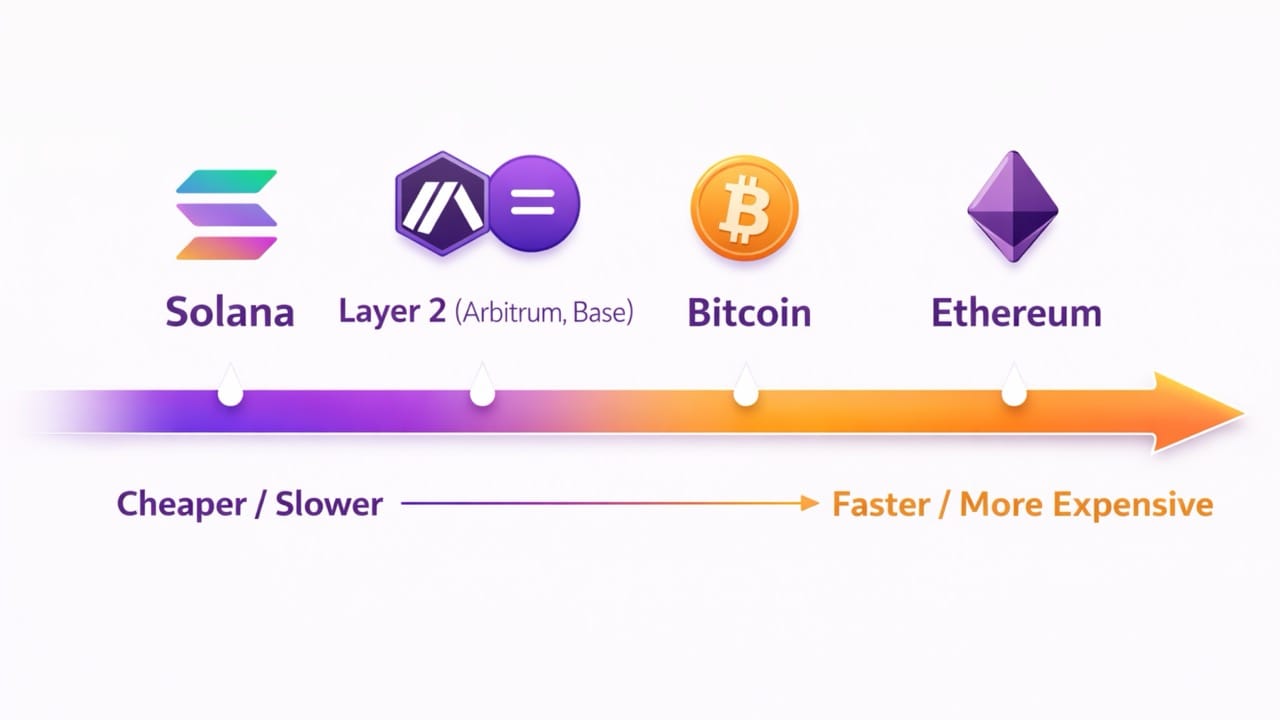

Different blockchains handle fees in different ways. That’s why the same type of payment can cost very little on one network and much more on another.

The difference comes from how each network manages traffic, confirmation speed, and capacity.

- Ethereum (ETH)

Ethereum fees are called gas. They change based on how busy the network is. When many people are transacting at the same time, fees rise. During peak activity, even simple transactions can become costly.

- Bitcoin (BTC)

Bitcoin fees depend on network congestion and how quickly you want the transaction confirmed. Paying a higher fee increases the chance your transaction is included in the next block.

- Layer 2 networks (Arbitrum, Base)

Layer 2 networks run on top of Ethereum and reduce fees by batching many transactions together before settling them on the main network. This usually makes everyday payments much cheaper.

- Solana

Solana fees are generally very low. The network is designed to process transactions quickly, but it supports a different ecosystem of apps and tools than Ethereum-based networks.

Fees rise or fall based on urgency and network conditions, not the wallet itself.

At a high level, fees change based on network conditions and urgency, not the wallet you’re using.

In practice, timing and network choice matter more than the app you send from. When fees rise, many users wait or switch networks instead of pushing a transaction through.

How To Choose A Reasonable Fee

Every payment forces a choice between time and cost.

If a transaction needs to confirm quickly, fees tend to be higher. If timing isn’t critical, waiting or using a different network usually costs less.

For small purchases or test payments, cheaper and slower options are often enough.For time-sensitive payments, paying more for speed can be reasonable.

Stablecoin payments on Layer 2 networks are often cheaper than sending funds directly on Ethereum mainnet.

Looking at the fee before you confirm doesn’t slow things down much, but it often prevents paying more than the situation actually requires.

Tools To Compare Fees

Fees are visible if you know where to look and these tools show what’s happening on each network right now:

- Etherscan Gas TrackerDisplays current Ethereum gas prices and how busy the network is.

- mempool.spaceShows Bitcoin transactions waiting to be confirmed and how fees affect confirmation time.

- Layer2fees.infoCompares typical fees across Ethereum Layer 2 networks side by side.

Checking one of these before you send gives context. Instead of wondering why a payment cost more than expected, you can see the conditions that caused it and decide whether to wait or move forward.

Tools Beginners Need to Spend Crypto Safely

You don’t need a complicated setup to spend crypto safely. A single wallet, one way to pay, and a small test transaction are enough to get started. Everything else can wait.

The tools below matter early because they’re part of the moment you actually send crypto.

Wallets

A wallet is how you access and control your crypto and where every payment begins.

Ledger: A hardware wallet that keeps keys offline. Often used for larger balances, but not required when you’re just starting to spend crypto.

Coinbase Wallet: Designed for simpler use cases and app connections. It’s separate from the Coinbase exchange and works well for everyday payments.

MetaMask: Common on Ethereum and compatible networks. Often used for online payments, and on-chain tools.

Practical note: It’s easier to learn one wallet well than to juggle several. Switching later is straightforward once the basics are familiar.

Payment processors

Some merchants don’t ask you to send crypto to a direct wallet address. Instead, they use payment processors that guide the checkout

- BitPay: Creates an invoice, shows the exact amount, and confirms when payment is complete.

- Coinbase Commerce: Lets merchants accept crypto directly, often with step-by-step checkout screens.

These tools reduce errors by fixing the amount and destination for you, instead of relying on manual copy-paste.

Browsers & extensions

Some payments happen inside web apps, which is where browsers and extensions come into play.

- Brave: A standard browser with built-in crypto support and privacy features.

- Phantom: A wallet extension mainly used for Solana-based apps and payments

You won’t need these for every transaction, but they’re common when interacting with web-based crypto services.

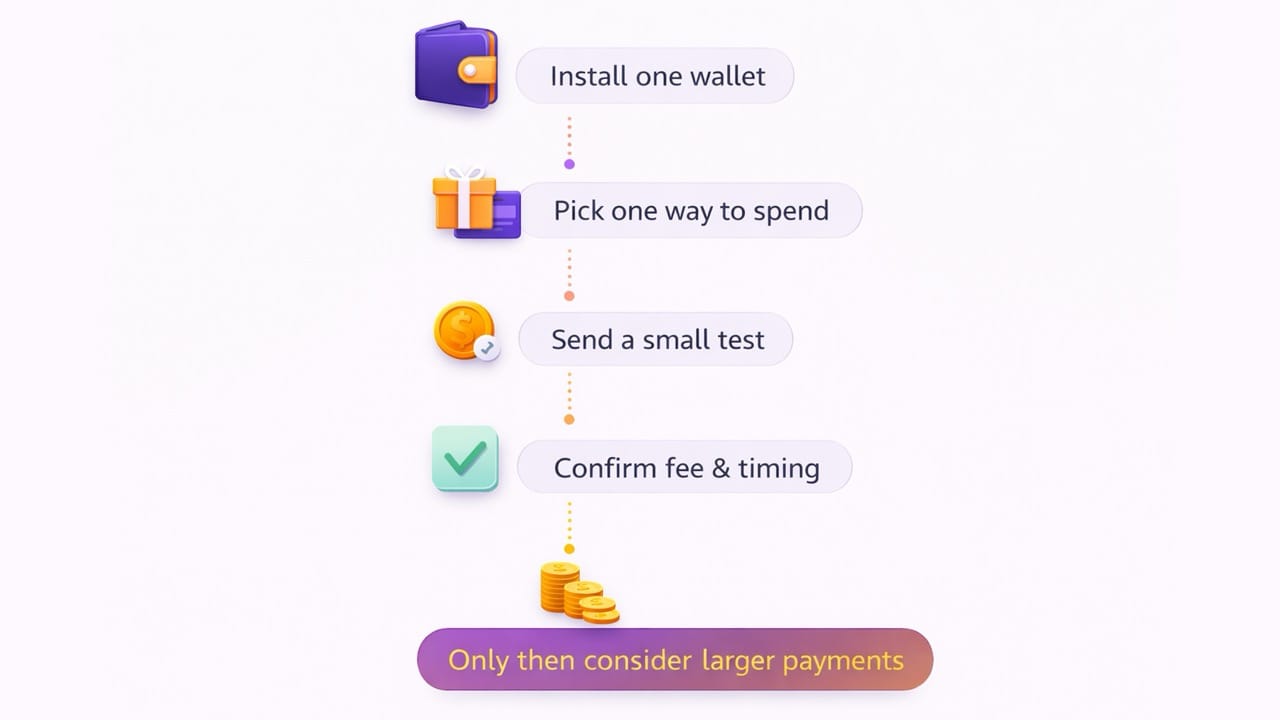

A simple starter setup

A first crypto payment usually follows the same pattern. People tend to repeat it once or twice before moving on to larger amounts.

That’s usually enough to understand how the flow works before scaling up.

Conclusion

Spending crypto in 2026 is more practical than it used to be, but it still works differently from card payments. Crypto cards, like the GoMining Card, bridge this gap by handling conversion at checkout while still settling from your crypto balance. Every transaction is a direct transfer, with fewer intermediaries and less room to fix mistakes after the fact.

That’s why early problems usually come from speed, not complexity. Rushing through a checkout, skipping a fee check, or sending a full amount before understanding the flow causes far more issues than the tools themselves.

People who use crypto regularly tend to develop a simple routine. They start with familiar options like gift cards, travel bookings, or crypto cards. They check the network and the fee before sending. And when something is new, they test with a small amount first.

One deliberate payment is a good start to connect all the pieces. You see where the funds leave your wallet, how long confirmation takes, and what fees actually apply. After that, the process is no longer theoretical.

Crypto is real money, just with different tools and rules. Once those rules are respected, spending crypto becomes a practical option you can use intentionally, not something you avoid or overthink.

FAQ

- Is spending crypto safe? Yes. Just note that direct crypto payments are usually irreversible, so often mistakes come from rushing. Always take a moment to check the wallet information of the receiver.

- Can I spend Bitcoin without high fees? Often, yes. Fees depend on network activity. Waiting, choosing a lower fee, or using Lightning can reduce costs.

- Crypto card or direct wallet payment? Cards are easier for everyday purchases. Direct wallet payments usually give more control and lower fees.

- Why do some stores accept only USDT or USDC? Stablecoins keep the amount consistent, which simplifies checkout and accounting for both sides.

- What if I send crypto to the wrong address? The network won’t reverse it. That’s why test transactions and careful checks matter.

- Are crypto payments anonymous? They’re public but not named. Transactions are visible, identities aren’t automatically attached.